Fixing the Claims Processing Experience with AI

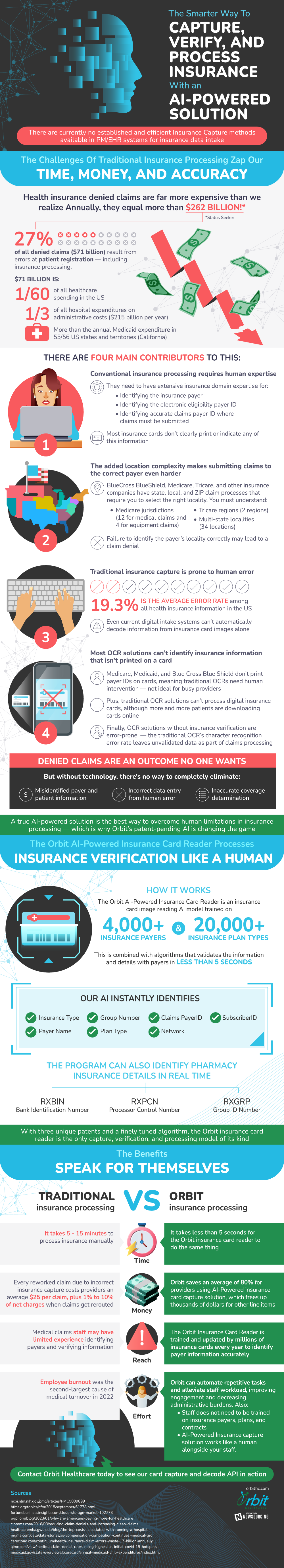

In the insurance sector, artificial intelligence (AI) is revolutionizing the claims processing system. Traditional methods pose a lot of setbacks- it is labor intensive, prone to mistakes, and cost ineffective. A lot of claims are not even approved due to the lack of proper information submission. In fact $71 billion is spent each year to fix errors committed at patient registration, which is right at the beginning of the claims submission process.

There are several sources of these errors. A lot of information is missing from insurance cards, including insurance payer details, electronic eligibility payer IDs, and claims payer IDs where the claims must be submitted. Without manually recording all of this information correctly, the claims will be denied. This problem is exacerbated by the fact that the current technology to record this information, OCR solutions, aren’t able to identify information that isn’t printed on a card.

AI insurance card capture proves to be the best answer to these problems. They have been trained from large data sets to be able to validate insurance information in less than five seconds, which is a huge improvement from the five to fifteen minutes needed for manual processing. There are also significant cost savings available with this technology, as companies can save up to $25 for each claim that they would otherwise have to resubmit.

Source: OrbitHC